Conference paper from The Economies of the Balkan and the Eastern European Countries in the changing world (EBEEC 2018), Warsaw, Poland

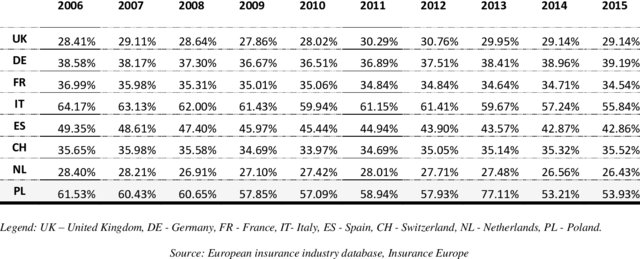

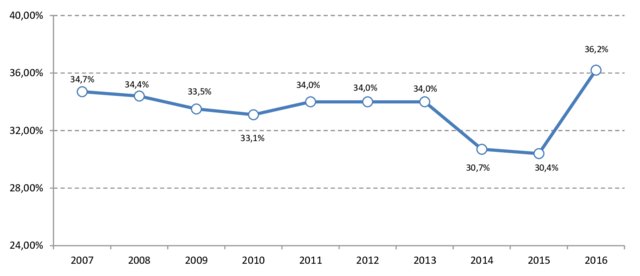

Motor insurance in Poland plays a dominant role in the portfolios of most insurers. At the end of 2016, it accounted for a total of 60.27% of the direct gross written premium of non-life insurance sector, with the share of motor third party liability insurance (MTPL) accounting for 36.2%. Fierce competition and the diminishing diversification of the offer on the motor insurance market led to significant decreases in the margin, and hence, the income of insurers. Year 2016 brought the biggest loss ever. The technical loss of MTPL has remained in this segment for many years since 2007 and at the end of 2016 exceeded PLN 1 billion.

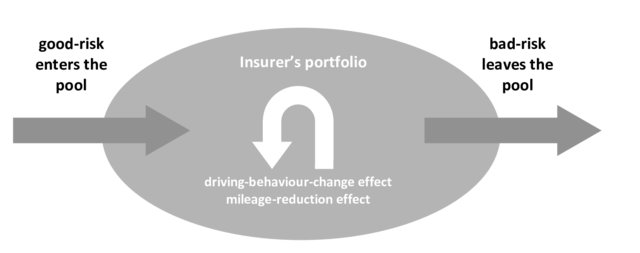

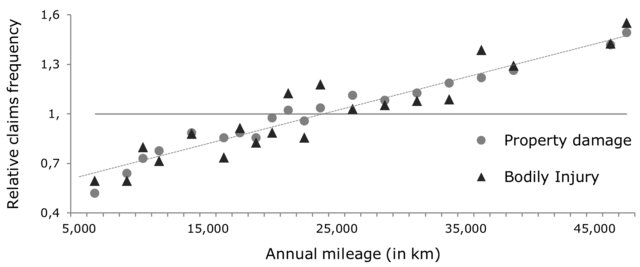

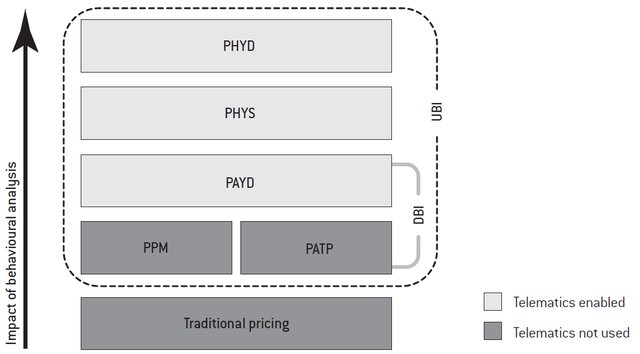

Although that is reflected in the visible increase in average premiums, which has been noticeable from the second quarter of 2016, it is often stressed that premiums are still set too low. It may be necessary to adopt a long-term policy that will lead to ensuring the stability and predictability of compulsory motor insurance on the market. It is recognized that to achieve this, more attention should be paid to the individualisation of premiums. Among insurance practitioners, there is a belief that the latest technological achievements such as telematics systems, allowing the implementation of Usage-Based Insurance (UBI) solutions, may help achieve this goal. Although insurance telematics may be an instrument of the individualisation of premiums and a source of competitive advantage, the Usage-Based Insurance is still an area which is insufficiently explored, especially in the context of the Polish insurance market. Accordingly, the main purpose of this paper is to facilitate a better understanding of the topic through a review and summary of selected literature and research achievements, which may prove useful in a discussion about domestic UBI. The paper presents both the historical perspective of UBI development and the summary of the research carried out over the last decade. It is concerned with the advancement of UBI tariffs and the successful modification of the applicable pricing schemes as well as points to issues that may hinder the market launch of UBI. Finally it shows that thanks to the Usage-Based Insurance, the industry can minimise the negative effect information asymmetry has on the Polish motor insurance market.

Keywords:

insurance telematics, motor insurance, market equilibrium, Pay-As-You-Drive (PAYD), Usage-Based Insurance (UBI),

JEL Classification:

G22

Figures

Credits

| Authors | Sliwiński, Adam; Kuryłowicz, Łukasz |

| SGH Warsaw School of Economics | |

| Date | 2018 |

| Type | Conference paper |

| Conference | The Economies of the Balkan and the Eastern European Countries in the changing world (EBEEC 2018) At: Warsaw, Poland |

| How to cite | Sliwinski A., Kurylowicz L. (2018). The lack of the equilibrium on the motor insurance market in Poland. EBEEC 2018, Warsaw, Poland |

Full text

Full text is available at ResearchGate

Additional resources

Presentation