Journal article in Acta Universitatis Lodziensis. Folia Oeconomica

Abstract

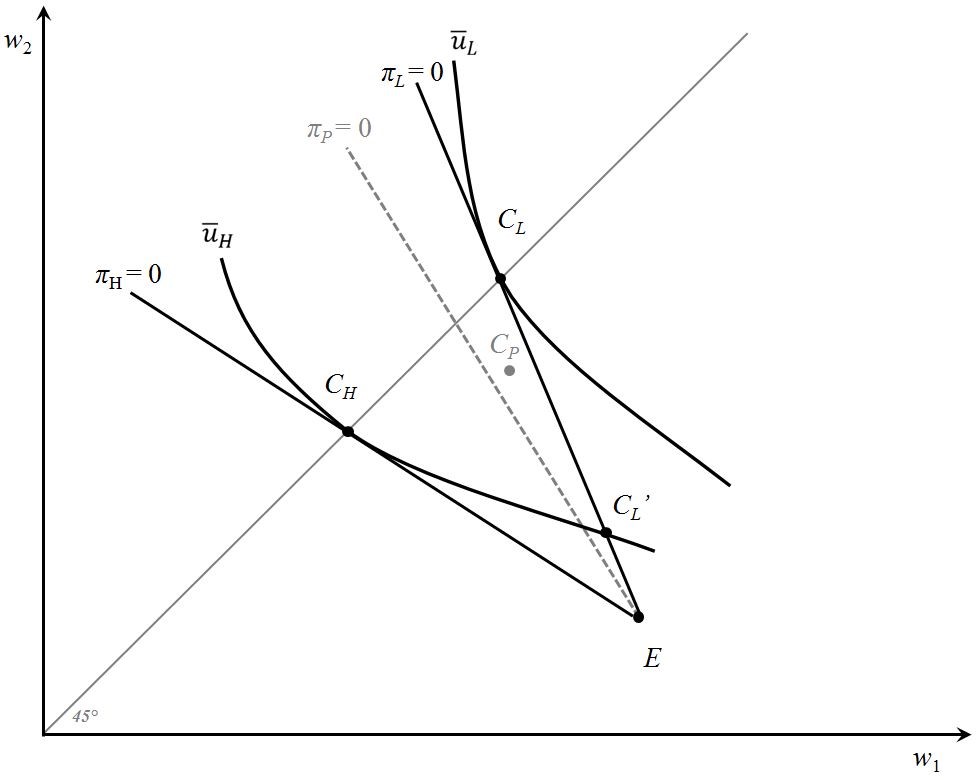

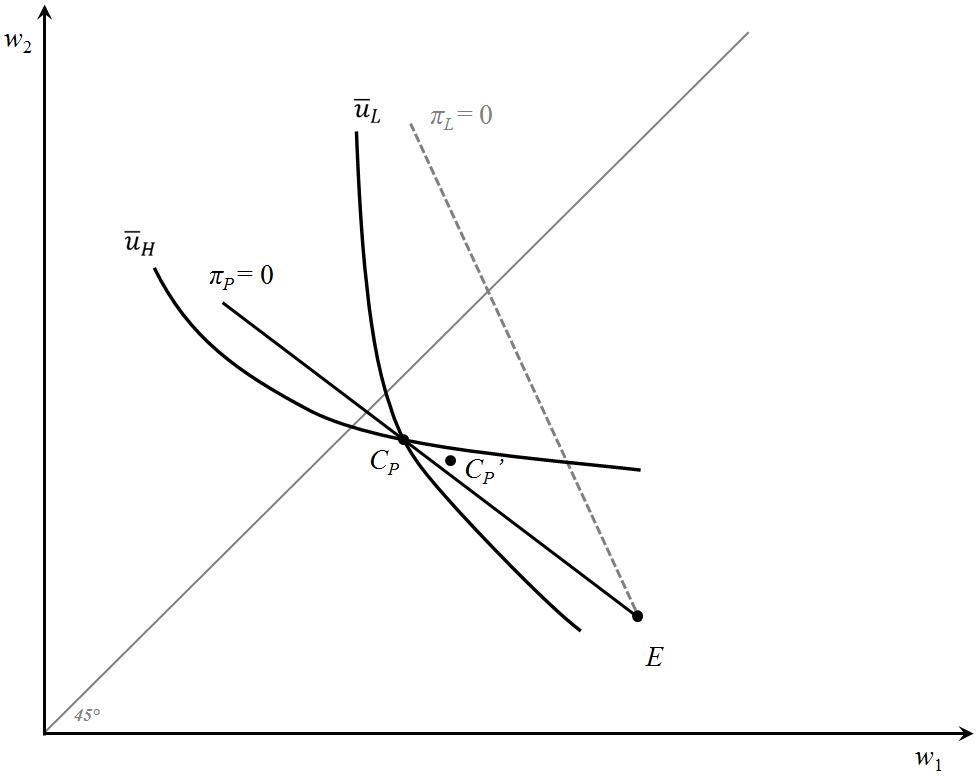

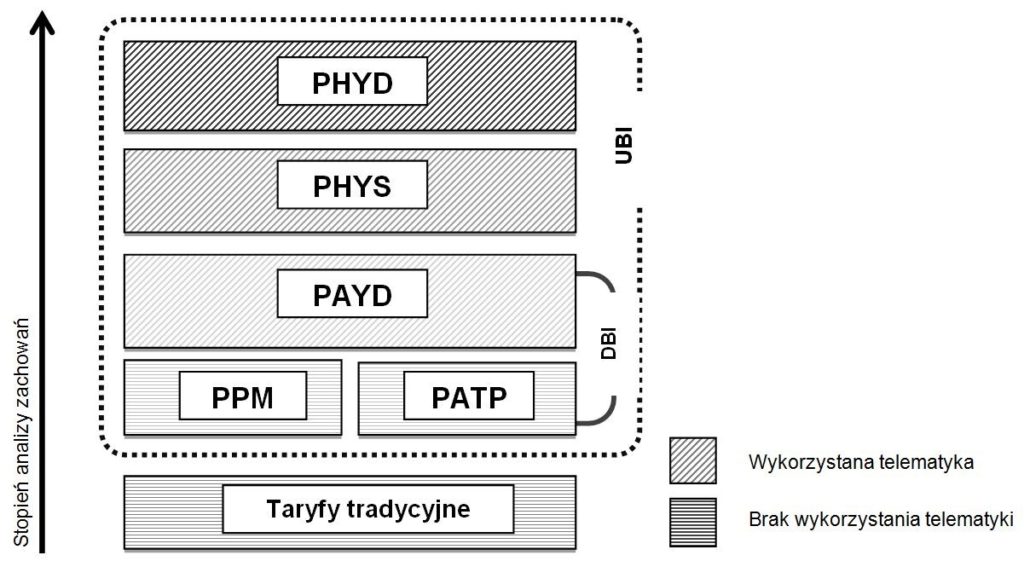

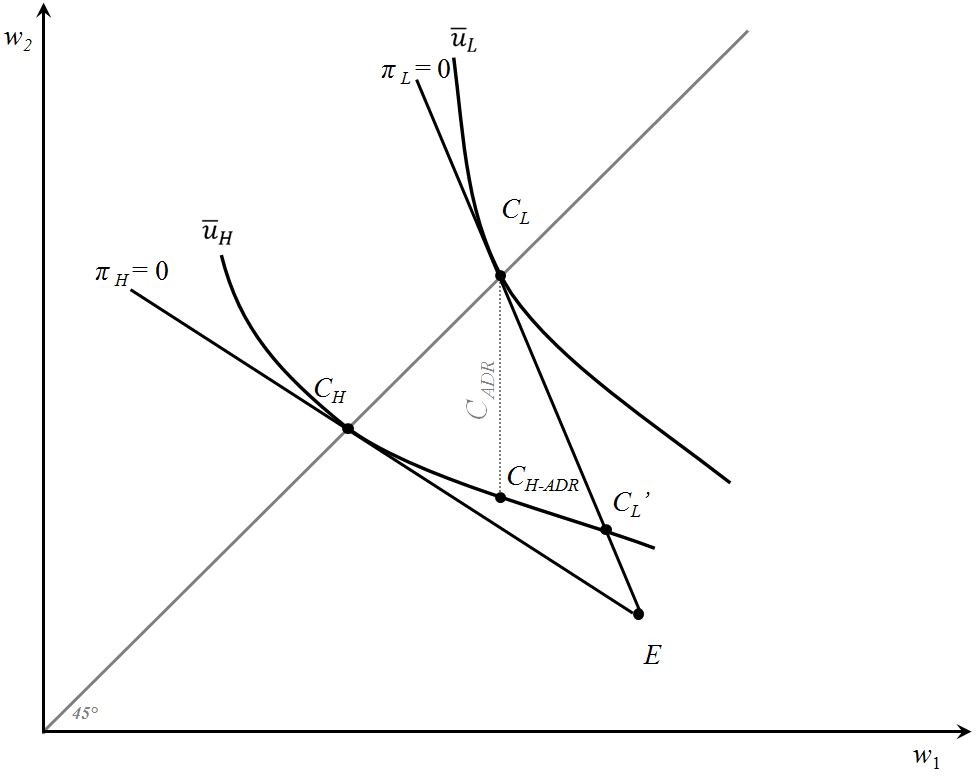

The paper shows that thanks to the Usage‑Based Insurance, the industry can minimise the negative effect information asymmetry has on the Polish motor insurance market. Through an economic analysis, the author gives the forecasts of the market models where three strategies for telematics implementation are used.

His research proves that not every scenario leads to the desired equilibrium and only the right strategy adopted to introduce telematics solutions onto the market will make it possible for the low‑risk individuals to receive the full coverage at an actuarially fair premium, which will constitute an improvement with regards to the Pareto efficiency, as opposed to their position where information asymmetry exists. This breakthrough can be achieved by implementing products using data from the so‑called black boxes or dongles.

Keywords:

insurance telematics, Usage‑Based Insurance (UBI), asymmetric information, market equilibrium

JEL Classification:

D82, C62, G22

Figures

Credits

| Authors | Kuryłowicz, Łukasz |

| Date | 2018 |

| Pages | 93-110 |

| Type | Journal article |

| ISSN | 0208-6018 |

| DOI | 10.18778/0208-6018.333.07 |

| How to cite | Kurylowicz L. (2018). Usage‑Based Insurance as an instrument of restoring equilibrium on motor insurance market in Poland. Acta Universitatis Lodziensis. Folia Oeconomica, 1(333), pp. 93-110 |

Full text

Full text in Polish is available at ResearchGate